- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Earnings Preview: What To Expect From Danaher's Report

/Danaher%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Washington, DC-based Danaher Corporation (DHR) is a leading global life sciences and diagnostics innovator, helping solve many of the world’s most important health challenges. It focuses on areas such as Life Sciences, Diagnostics, Biotechnology, and more. Valued at $145 billion by market cap, Danaher employs thousands of people and operates in 50+ countries and 700 different locations across the globe.

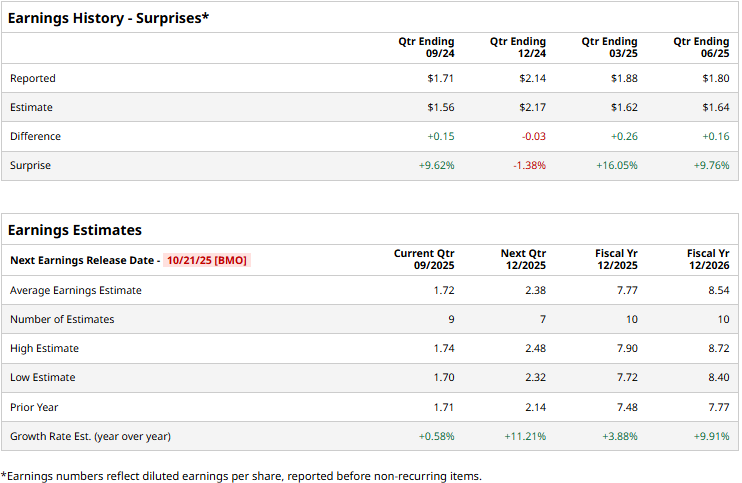

The healthcare giant is gearing up to announce its third-quarter results before the market opens on Tuesday, Oct. 21. Ahead of the event, analysts expect Danaher to report an adjusted profit of $1.72 per share, marginally up from $1.71 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates once over the past four quarters, it surpassed the projections on three other occasions.

For the full fiscal 2025, DHR is expected to report an adjusted EPS of $7.77, up 3.9% from $7.48 in 2024. While in fiscal 2026, its earnings are expected to grow 9.9% year-over-year to $8.54 per share.

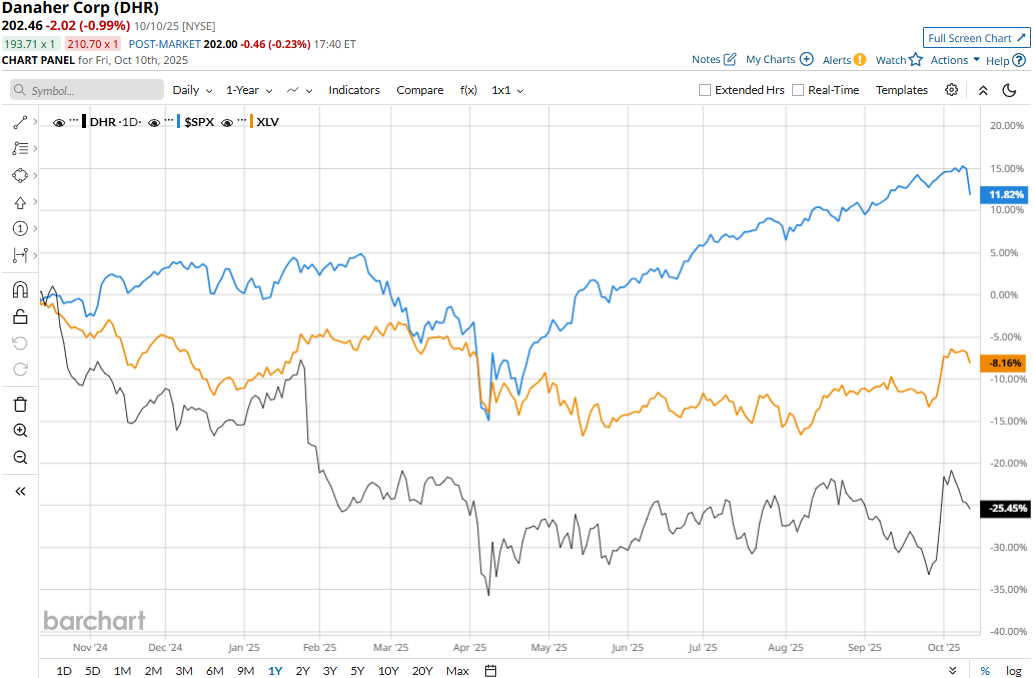

DHR stock prices have plummeted 24% over the past 52 weeks, notably underperforming the Health Care Select Sector SPDR Fund’s (XLV) 7% decline and the S&P 500 Index’s ($SPX) 13.4% returns during the same time frame.

Danaher’s stock prices gained nearly 1% in the trading session following the release of its robust Q2 results on Jul. 22 and maintained a positive momentum for the next three trading sessions. Driven by the robust performance of its bioprocessing business, the company’s topline for the quarter grew 3.4% year-over-year to $5.9 billion, beating the Street’s expectations by 1.7%. Further, its adjusted EPS grew by 4.7% year-over-year to $1.80, surpassing the consensus estimates by 9.8%.

The recent price movement in DHR stock can be attributed to the fluctuations in healthcare-related policies made by the Federal government. However, the company’s longer-term prospects remain intact.

The consensus opinion on DHR stock is strongly bullish, with an overall “Strong Buy” rating. Out of the 23 analysts covering the stock, 18 recommend “Strong Buys,” one advises “Moderate Buy,” and four suggest a “Hold” rating. Its mean price target of $240.75 indicates an 18.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.