- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

What to Expect From Quest Diagnostics’ Next Quarterly Earnings Report

/Quest%20Diagnostics%2C%20Inc_%20logo%20on%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

Valued at $20.6 billion by market cap, Secaucus, New Jersey-based Quest Diagnostics Incorporated (DGX) provides diagnostic testing services in the U.S. and internationally. The company develops and delivers diagnostic information services, such as routine, non-routine, and advanced clinical testing, anatomic pathology testing, and other diagnostic information services.

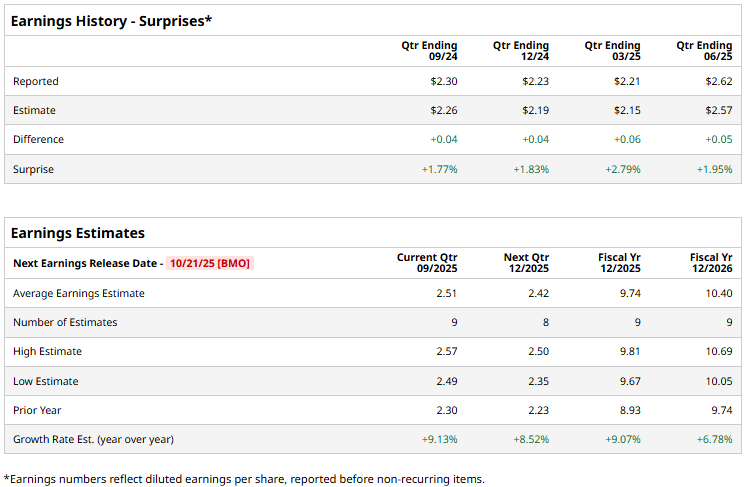

The healthcare major is gearing up to announce its third-quarter results before the market opens on Tuesday, Oct. 21. Ahead of the event, analysts expect DGX to deliver an adjusted profit of $2.51 per share, up 9.1% from $2.30 per share reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, DGX is expected to deliver an adjusted EPS of $9.74, up 9.1% from $8.93 in 2024. While in fiscal 2026, its earnings are expected to grow 6.8% year-over-year to $10.40 per share.

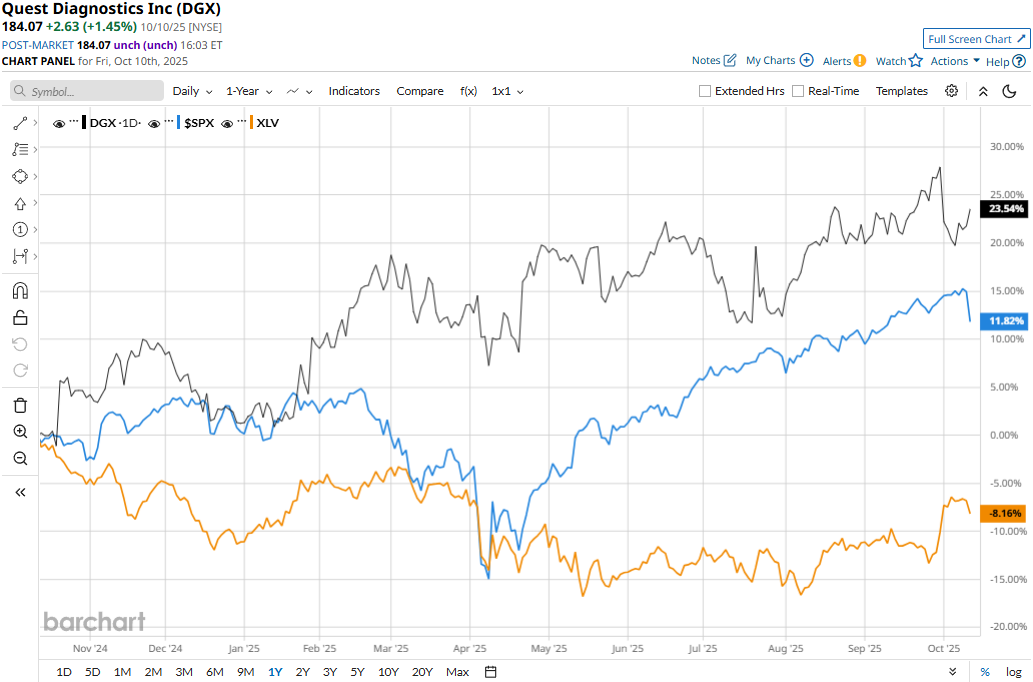

DGX stock prices have soared 24.5% over the past 52 weeks, notably outperforming the Healthcare Select Sector SPDR Fund’s (XLV) 7% decline and the S&P 500 Index’s ($SPX) 13.4% gains during the same time frame.

Quest Diagnostics’ stock prices soared 7.1% in the trading session following the release of its impressive Q2 results on Jul. 22. Driven by the organic demand of its innovative clinical solutions and growth from acquisitions, the company’s overall net revenues for the quarter surged 15.2% year-over-year to $2.8 billion, beating the Street’s expectations by 1.5%. Further, the company observed some productivity gains, driven by its deployment of automation and digital technologies in its operations. DGX delivered 11.5% growth in adjusted EPS to $2.62, surpassing the consensus estimates by nearly 2%.

Analysts remain optimistic about the stock’s long-term prospects. DGX has a consensus “Moderate Buy” rating overall. Of the 18 analysts covering the stock, eight suggest “Strong Buys” and 10 recommend “Holds.” As of writing, the stock is trading slightly below its mean price target of $189.94.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.