- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

3M Company's Quarterly Earnings Preview: What You Need to Know

/3M%20Co_%20manufacturing%20plant-by%20jetcityimage%20via%20iStock.jpg)

Saint Paul, Minnesota-based 3M Company (MMM) is a diversified conglomerate, operating through Safety and Industrial, Transportation and Electronics, and Consumer segments. With a market cap of $79.2 billion, 3M produces thousands of products, including adhesives, passive fire protection, window films, car-care products, and more, under various brands.

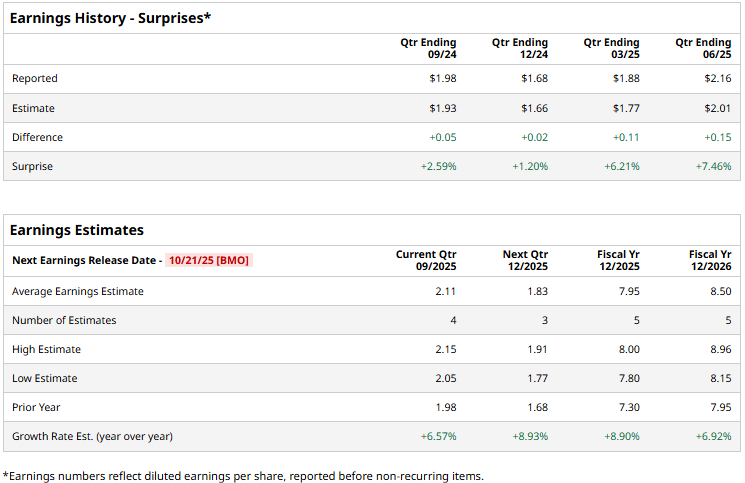

The conglomerate is set to announce its Q3 results before the market opens on Tuesday, Oct. 21. Ahead of the event, analysts expect 3M to report a non-GAAP profit of $2.11 per share, up 6.6% from $1.98 per share reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, 3M’s adjusted EPS is expected to come in at $7.95, up 8.9% from $7.30 reported in 2024. While in fiscal 2026, its earnings are expected to grow 6.9% year-over-year to $8.50 per share.

MMM stock prices have gained 11.5% over the past 52 weeks, outpacing the Industrial Select Sector SPDR Fund’s (XLI) 10.2% gains but underperforming the S&P 500 Index’s ($SPX) 13.4% returns during the same time frame.

Despite delivering better-than-expected results, 3M’s stock price declined 3.7% in the trading session following the release of its Q2 results on Jul. 18. The company’s GAAP sales came in at $6.3 billion, up 1.4% year-over-year, while its adjusted sales grew 2.3% year-over-year to $6.2 billion, surpassing the Street’s expectations by a small margin. Meanwhile, its non-GAAP margins observed a significant expansion, leading to a 12% surge in adjusted EPS to $2.16, exceeding the consensus estimates by 7.5%.

Further, 3M raised its full-year EPS guidance from the previous range of $7.60 - $7.90 to $7.75 - $8.00. However, given the substantial drop in tariff rates from the initially announced rates, this improvement in outlook likely didn’t meet investor expectations.

Analysts remain optimistic about the stock’s prospects. 3M has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include 10 “Strong Buys,” four “Holds,” one “Moderate Sell,” and two “Strong Sells.” Its mean price target of $164 suggests a 10.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.